Categories

- All Blogs (86)

- 30A Communities & Condos (1)

- Communities and Condos on the Emerald Coast (1)

- Destin Communities & Condos (2)

- Fort Walton Beach Communities & Condos (2)

- Home Selling TIps (1)

- Investment & Rental Strategy (1)

- Local Real Estate Answers (28)

- Military Relocation & VA Buyers (1)

- Waterfront & Coastal Homes (1)

Recent Posts

Living in Destin vs. Fort Walton Beach: Which Is Right for You?

30A Investment Property: Short-Term Rental vs. Long-Term Rental

Selling with the Emerald Group vs. Listing For Sale By Owner (FSBO)

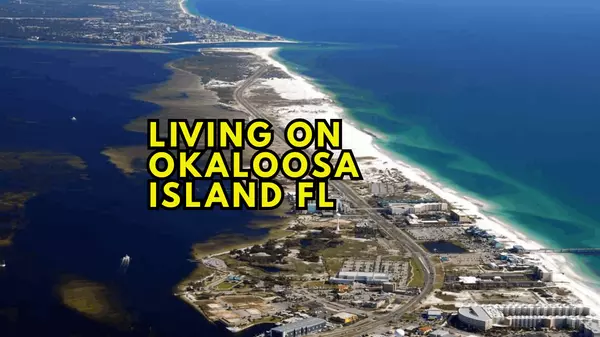

Living on Okaloosa Island Florida | Driving Tour, Beaches, and Local Life

Military Relocation Specialist vs. Generic Buyer's Agent

Buying a Home Solo vs. Working with the Emerald Group

What Can $1 Million Buy on 30A Real Estate in Late 2025 / Early 2026?

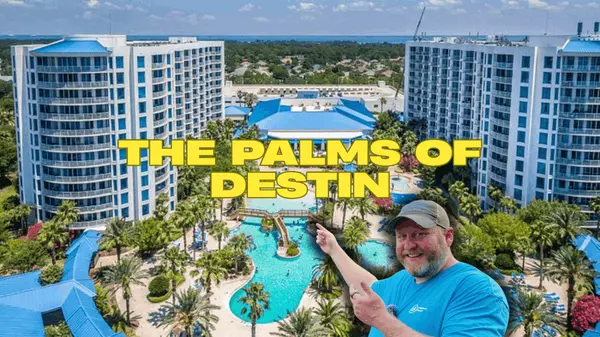

Is The Palms of Destin a Good Place to Buy a Condo?

Emerald Group vs. a Typical Real Estate Agent: What’s the Difference?

Local Real Estate Expert vs. National Search Sites (Zillow, Redfin, etc.)

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "